This Week In The Economy: COVID Vaccine Production Coming to Select African Countries, Fed Guidance On Rate Hikes, and More

By Brai Odion-Esene

February 21, 2022

Six African Countries To Begin COVID-19 Vaccine Production

The World Health Organization announced this week that six African nations have successfully applied to receive the technology needed to produce COVID-19 mRNA vaccines.

Egypt, Kenya, Nigeria, Senegal, South Africa and Tunisia will now work with the WHO and its partners to “develop a roadmap and put in place the necessary training and support so that they can start producing vaccines as soon as possible,” the agency said.

The global mRNA technology transfer hub was set up last year to help low- and middle-income countries produce their own vaccines, providing them with the necessary operating procedures and know-how to manufacture mRNA vaccines in large volumes and according to international standards.

The WHO noted that while initially focused on tackling the COVID-19 pandemic, the hub has the potential to expand manufacturing capacity for other critical medical products as well, “such as insulin to treat diabetes, cancer medicines and, potentially, vaccines for other priority diseases such as malaria, tuberculosis and HIV.”

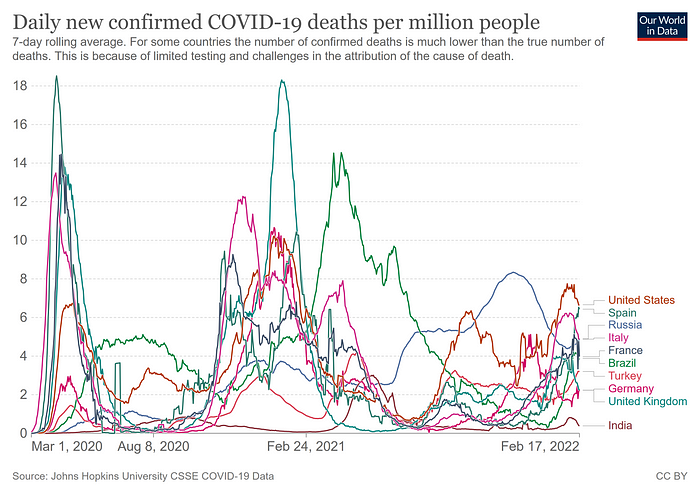

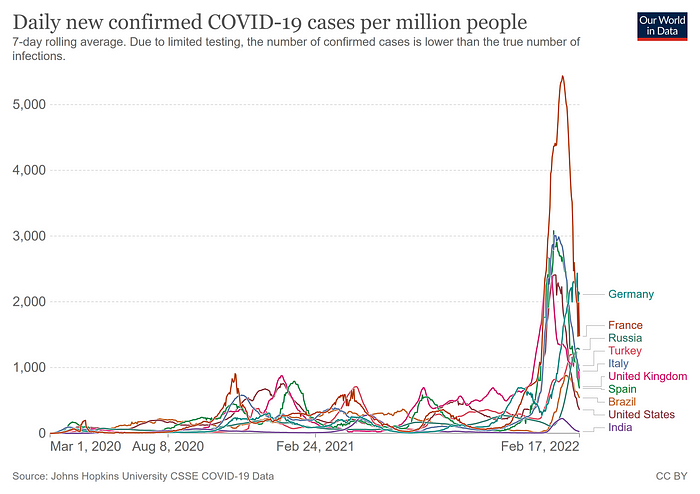

This week also saw an easing in the number of COVID-19 cases and fatalities being reported globally, as we move further away from the omicron wave that swept through much of the world at the beginning of winter.

Speaking at the weekly briefing of White House and public health officials, Centers for Disease Control Director Rochelle Walensky said the current seven-day daily average of cases is about 147,000 cases per day, a decrease of about 40% over the previous week.

The seven-day average of hospital admissions is about 9,500 per day, -28% vs. the previous week.

And, the seven-day average of daily deaths are about 2,200 per day, down about 9% from the previous week.

“Omicron cases are declining, and we are all cautiously optimistic about the trajectory we are on. Things are moving in the right direction, but we want to remain vigilant to do all we can so that this trajectory continues,” Walensky said.

Going forward, the CDC chief said her agency will be monitoring not just the number of cases “which continue to result in substantial or high community transmission in over 97 percent of our counties in the country, but critically, medically severe disease that leads to hospitalizations.”

“We must consider hospital capacity as an additional important barometer,” Walensky added, “our hospitals need to be able to take care of people with heart attacks and strokes. Our emergency departments can’t be so overwhelmed that patients with emergent issues have to wait in line.”

The CDC reported that as of February 17th, 684,648,105 total doses of the COVID-19 vaccine have been distributed to states, compared to 674,675,725 a week ago. Of this week’s overall number, 548,934,364 shots have been administered. Of the doses administered, 252,539,755 Americans have received at least one shot (76.1% of the entire population), and 214,474,721 have been fully vaccinated (64.6%). Of the fully vaccinated, 92,372,036 have received a booster shot, 43.1% of that group.

Worldwide, 10,483,059,250 doses have now been administered, but there is still a gap between the haves and have-nots:

Globally, there have now been 417,730,572 confirmed cases of COVID-19, and the number of people killed by the coronavirus rose to 5,850,628. The U.S. now has 78,196,541 confirmed cases, and there have been 930,302 fatalities.

India has 42,780,235 confirmed cases. Of that number, 292,092 are active and there have been 510,905 fatalities. The data shows 72% of India’s population has received at least one jab of the COVID-19 vaccine, and 58% are fully vaccinated.

Brazil remains in third place with 27,937,835 cases at time of writing and 641,902 deaths. France is in fourth place with 22,028,827 cases and 135,924 fatalities.

The United Kingdom is fifth with 18,499,058 cases and 160,221 fatalities. Russia is in sixth with 15,020,573 confirmed cases and 343,957 deaths.

Turkey is seventh with 13,266,265 cases and 91,646 dead. Germany moved up to eighth place with 13,255,989 cases and 120,992 deaths.

Italy is down to ninth place with 12,323,398 and 152,282 fatalities. Spain is down to tenth with 10,744,394 confirmed cases and 97,350 fatalities.

China Producer Prices Eased in January, Good News for Rest of The World?

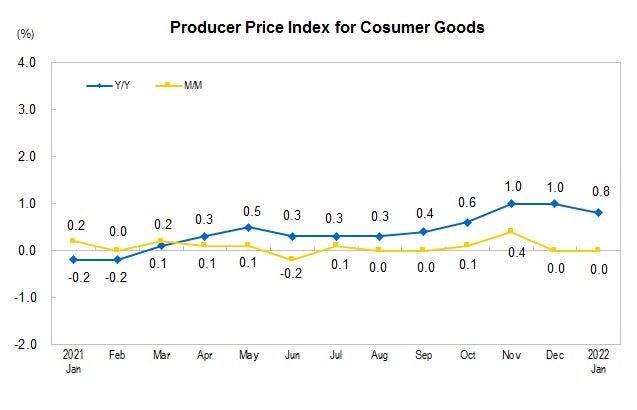

China’s National Bureau of Statistics reported this week that wholesale prices rose by 9.1% year-on-year in January, slowing down from the 10.3% increase reported for December, and dropped by 0.2% month on month.

As the supply of goods to most of the world, the question is whether this dip in prices will translate into easing price pressures elsewhere — particularly in Western countries where inflation has soared to record levels.

In a hopeful sign, the wholesale prices for consumer goods were flat between December and January.

U.S. Data Roundup: Wholesale Prices Continue To Surge, Inflation Boosting Retailers’ Revenue, More-Expensive Housing Market

The Bureau of Labor Statistics reported this week that U.S. wholesale prices jumped again in January, an ominous sign for consumer prices this month as those costs were likely passed on.

The Producer Price Index for final demand increased 1% month-over-month in January, following advances of 0.4% in December 2021 and 0.9% in November. Compared to a year ago, wholesale prices are up 9.7%.

Wholesale prices for goods continue to drive the increase, as the index for final demand services rose 0.7%, while prices for final demand

goods moved up 1.3%.

Excluding food, energy, and trade services, wholesale prices jumped 0.9% in January 2022, the largest monthly increase since rising 1% in January 2021.

Meanwhile U.S. retailers enjoyed a strong surge in sales last month, part of which can be attributed to higher prices.

The Census Bureau reported that retail sales rose 3.8% last month and were up 13% compared to January 2021. The monthly increase was the largest month-over-month jump since stimulus checks went out in March 2021.

Core retail sales — excluding gasoline and automotive sales — also rose by 3.8% in January and are up 11.4% compared to a year ago.

Not surprisingly given the recent surge in energy prices, sales at gasoline stations were down 1.3% from December, while auto sales — with prices still elevated due to supply chain issues — were up by almost 6%.

Concerns about the Omicron COVID-19 wave caused restaurant sales to dip by 0.9%, while e-commerce soared 14.5%. Housing market activity maintained its strong pace, as furniture store sales rose 7%, while building materials and supplies were up 4%.

Speaking of the housing market, the National Association of Realtors reported this week that existing-home sales increased 6.7% in January from the prior month, with sales up in all regions.

However, the inventory of unsold existing homes fell to a new all-time low of 860,000, which is equivalent to just 1.6 months of supply, also an all-time low. So, it is no surprise that the median existing-home sales price rose at a stronger pace of 15.4% on a year-over-year basis, to $350,300.

The NAR noted that homes priced at $500,000 and below are disappearing, while supply has risen at the higher price range, and that such increases will continue to shift the mix of buyers toward high-income consumers.

“First, some moderate-income buyers who barely qualified for a mortgage when interest rates were lower will now be unable to afford a mortgage,” the group said. “Second, consumers in expensive markets, such as California and the New York City metro area, will feel the sting of nearly an additional $500 to $1000 in monthly payments due to rising rates.”

On the manufacturing front, the Federal Reserve reported that industrial production increased 1.4% in January. Manufacturing output and mining production rose 0.2% and 1%, respectively. Utilities’ output jumped 9.9% as the demand for heating surged in January due to “significantly colder-than-normal temperatures.”

Federal Reserve Officials Expect ‘Faster Pace’ of Rate Increases, But Remain Flexible

Federal Reserve officials expect to increase borrowing costs at a faster rate than the last time the central bank raised interest rates but that their actions will be guided by the reality on the ground.

The minutes from the January 25–26 meeting of the Federal Open Market Committee, during which the group chose to leave rates unchanged, show that officials felt that compared with conditions in 2015 — when the FOMC last began tightening monetary conditions — “there was a much stronger outlook for growth in economic activity, substantially higher inflation, and a notably tighter labor market.”

“Consequently, most participants suggested that a faster pace of increases in the target range for the federal funds rate than in the post-2015 period would likely be warranted, should the economy evolve generally in line with the Committee’s expectation,” the report said.

While there has been much speculation about how quickly the Fed will raise interest rates, the minutes said any subsequent actions would depend on economic and financial developments as well as their implications for the outlook. Fed officials “will be updating their assessments of the appropriate setting for the policy stance at each meeting,” it said.

As for the winding down of the central bank’s bond-buying program, FOMC participants retained their belief that asset purchases should be concluded soon, citing “elevated inflation pressures and the strong labor market.”

“Most participants preferred to continue to reduce the Committee’s net asset purchases according to the schedule announced in December, bringing them to an end in early March,” it added.

Omicron Wave Dampens European Economic Activity In Q4 2021

In news that might not bode well for economic growth in Q1 2022, Eurostat reported this week that economic activity expanded at a significantly slower pace in both the euro area and the broader European Union in the final quarter of 2021.

As countries restricted movement and business activity in response to the rapid spread of the Omicron variant, eurozone GDP increased by just 0.3% in Q4, and by 0.4% in the EU. In Q3 2021, GDP had grown by 2.3% in the euro area and by 2.2% in the EU.

But there might be a turnaround ahead, as economic sentiment in Europe’s largest economy continued to improve this month despite ongoing economic and geo-political risks.

The ZEW Indicator of Economic Sentiment for Germany increased in the current February 2022 survey. The assessment of the economic situation in Germany also improved in the current survey.

“Financial market experts expect an easing of pandemic-related restrictions and an economic recovery in the first half of 2022. They still expect inflation to decline, albeit at a slower pace and from a higher level than in previous months,” it said.

All Posts

All Posts