This Week In The Economy: Omicron Vaccine Study, Fed Rate Increase Coming Soon, Global Economy In A Weaker Position, and More

By Brai Odion-Esene

January 29, 2022

This Week In The Economy: Omicron Vaccine Study, Fed Rate Increase Coming Soon, Global Economy In A Weaker Position, Glimmer of Hope For Germany, Central Banks’ Inflation Fight

Pfizer Exploring Omicron-Focused Vaccine

Pharmaceutical company Pfizer this week announced it is initiating a study to evaluate the “safety, tolerability and immunogenicity” of an Omicron-based vaccine candidate in healthy adults.

The company said this action is driven by the potential need for variant-specific vaccines. “While current research and real-world data show that boosters continue to provide a high level of protection against severe disease and hospitalization with Omicron, we recognize the need to be prepared in the event this protection wanes over time and to potentially help address Omicron and new variants in the future,” it said in its statement.

“Staying vigilant against the virus requires us to identify new approaches for people to maintain a high level of protection.”

On the subject of vaccine boosters, Pfizer in a separate announcement published the results of two laboratory studies showing that three doses of the Pfizer-BioNTech COVID-19 Vaccine elicited antibodies that neutralize the Omicron variant.

The administration is also boosting schools’ COVID-19 testing ability so they can stay safe and open. In addition to billions of dollars in funding to schools for COVID testing programs, the White House will increase the number of COVID-19 tests (PCR and rapid) available to schools by 10 million per month.

Speaking at the weekly briefing of White House and public health officials, COVID-19 coordinator Jeff Zients said 70% of eligible seniors have now gotten their booster shot, and half of all eligible adults are now boosted.

He also noted that of the 1.2 billion vaccine doses promised by the U.S. government to the rest of the world, 400 million vaccine doses shipped to 112 countries.

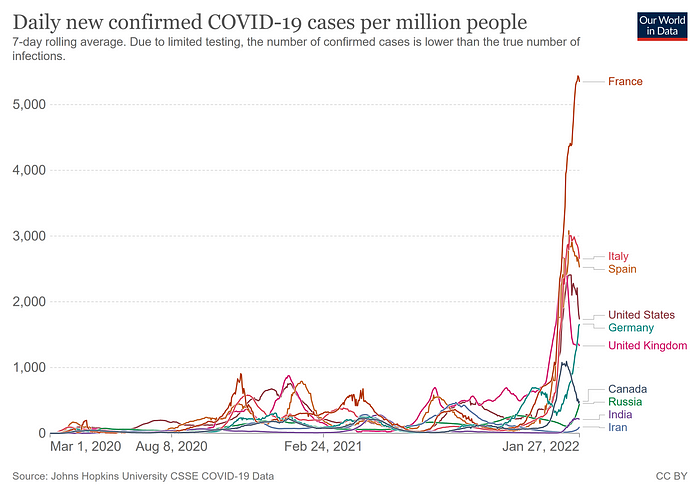

Also speaking during briefing, CDC Director Rochelle Walensky said the current seven-day daily average of cases is about 692,400 cases per day, a decrease of about 6% over the previous week.

The seven-day average of hospital admissions is about 19,800 per day, a decrease of about 8% over the prior week.

And the seven-day average daily deaths are about 2,200 per day, which is an increase of about 21% over the previous week.

She noted that hospitalizations have rapidly increased in a short amount of time, putting a strain on many local health systems.

“Although it’s encouraging that Omicron appears to be causing less severe disease, it’s important to remember that we are still facing a high overall burden of disease,” Walensky said.

“Importantly, ‘milder’ does not mean ‘mild.’ And we cannot look past the strain on our health systems and substantial number of deaths … as a result of the extremely transmissible Omicron variant,” she added.

The CDC reported that as of January 27th, 663,451,855 total doses of the COVID-19 vaccine have been distributed to states. Of this week’s overall number, 536,370,947 shots have been administered. Of the doses administered, 249,267,851 Americans have received at least one shot (75.1% of the entire population), and 211,162,083 have been fully vaccinated (63.6%). Of the fully vaccinated, 86,484,618 have received a booster shot, 41% of that group.

Worldwide, 10,004,517,134 doses have now been administered, but the divide remains between the haves and have-nots:

Globally, there have now been 362,417,416 confirmed cases of COVID-19, and the number of people killed by the coronavirus rose to 5,626,669. The U.S. now has 73,423,879 confirmed cases, and there have been 877,815 fatalities.

India has 40,622,709 confirmed cases. Of that number, 2,105,611 are active and there have been 492,327 fatalities. The data shows 70% of India’s population has received at least one jab of the COVID-19 vaccine, and 52.6% are fully vaccinated.

Brazil remains in third place with 24,764,838 cases at time of writing and 625,085 deaths. France has surged up to fourth place with 17,782,057 cases and 129,813 fatalities.

The United Kingdom is down to fifth with 16,245,474 cases and 155,040 fatalities. Russia is down to sixth with 11,502,657 confirmed cases and 329,443 deaths.

Turkey is seventh with 11,250,107 cases and 86,661 dead. Italy is in eighth place with 10,539,601 and 145,159 fatalities.

Spain moved up to ninth with 9,529,320 confirmed cases and 92,591 fatalities. Germany dropped to tenth with 9,429,079 cases and 117,484 deaths.

Federal Reserve Signals Rate Increase Soon With Inflation ‘Elevated’

The Federal Open Market Committee — the Fed’s policymaking body — met this week. While the group decided to leave its target interest rate unchanged, it did signal that it would raise rates at its next gathering.

“With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate,” the FOMC said.

The statement cited “solid” job gains in recent months and the substantial drop in the unemployment rate. “Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation,” it added.

The next FOMC meeting takes place March 15–16.

The U.S. Bureau of Economic Analysis reported this week that the economy grew by 6.9% in the fourth quarter of 2021, following an increase of 2.3% in Q3. It said the rapid expansion in Q4 was led by a jump in exports as well as accelerations in inventory investment and consumer spending.

In a separate release, the BEA reported that the December personal consumption expenditures (PCE) price index — the Fed’s preferred inflation measure — increased 5.8% from one year ago. Energy prices increased 29.9% while food prices increased 5.7%. Excluding food and energy, the PCE price index for December increased 4.9% from one year ago.

Meanwhile, personal income increased by just 0.3% at a monthly rate, while consumer spending decreased 0.6% in December.

IMF Warns Global Economy Entering 2022 In A Weaker Position

World economic activity is expected to grow at a slower pace this year compared to 2021, the International Monetary Fund warned this week, blaming the emergence of new COVID-19 variants and the spike in consumer prices.

“The global economy enters 2022 in a weaker position than previously expected,” it said its January update to its World Economic Outlook. In addition to the return of lockdown measures due to the Omicron COVID-19 variant, rising energy prices and supply disruptions have resulted in higher and more broad-based inflation, while real estate problems and the slower-than-expected recovery of consumer spending in China have also limited growth prospects.

The IMF’s economists forecast that global growth will moderate from 5.9% in 2021 to 4.4% in 2022 — largely reflecting forecast markdowns in the two largest economies, the United States and China.

For the U.S., the stalled Build Back Better fiscal policy package, faster rate increases by the Federal Reserve, and continued supply shortages contribute to the slower pace of economic activity. In China, the IMF cited the country’s zero-tolerance COVID-19 policy and the protracted financial stress among property developers.

Global growth is expected to slow to 3.8% in 2023.

The IMF said ongoing supply chain disruptions and high energy prices continuing in 2022 mean that “elevated inflation” is expected to persist for longer than previously envisioned.

“The emergence of new COVID-19 variants could prolong the pandemic and induce renewed economic disruptions. Moreover, supply chain disruptions, energy price volatility, and localized wage pressures mean uncertainty around inflation and policy paths is high,” it said.

Furthermore, the financial stability of emerging market and developing countries is at risk from rising interest rates in advanced economies. It could spark outward capital flows, a drop in currency values, and precarious fiscal positions, with debt levels having increased significantly in the past two years.

To compound matters, “other global risks may crystallize as geopolitical tensions remain high, and the ongoing climate emergency means that the probability of major natural disasters remains elevated,” the IMF concluded.

Omicron Wave Tripped Up German Economy In Q4 2021, But ‘Glimmer of Hope’ For 2022

Activity in Europe’s largest economy contracted in the final quarter of 2021, with recovery interrupted by due the rapid transmission of the Omicron Covid-19 variant and the resulting lockdown measures imposed by the government.

The German national statistics agency reported that GDP fell by 0.7% in Q4 from Q3 2021. Q4 GDP was up 1.4% compared to Q4 2020, but was still 1.5% lower than Q4 2019, the quarter before the Covid-19 crisis.

On the flipside, the iFo Institute reported this week that sentiment among German companies “brightened” to start the year.

“While companies’ assessments of the current situation were somewhat less positive, their expectations improved considerably. The German economy is starting the new year with a glimmer of hope,” it said.

In the country’s dominant manufacturing sector, the report noted a significant improvement in sentiment. With a slight easing in supply chain bottlenecks, iFo said “companies were more satisfied with their current business,” and also “more optimistic about the coming months.”

There was an improvement for exporters, another key driver of economic growth. “While companies’ assessments of their current situation were slightly worse, their expectations brightened noticeably,” it said.

Global Central Bank Roundup: Policy Rates Hiked To Combat High Inflation

- At its Monetary Policy Meeting, the Board of the Central Bank of Chile decided to raise the monetary policy interest rate by 150 basis points, to 5.5%. “The evolution of inflation continues to face significant risks and their possible materialization becomes especially relevant in a context where both the annual change in the CPI and its outlook are already high,” it said.

- The Reserve Bank of South Africa’s Monetary Policy Committee voted to increase the repurchase rate by 25 basis points to 4% per year. “Headline inflation has increased well above the mid-point of the inflation target band, and returns close to the mid-point in the fourth quarter of 2022. Some risks to the inflation outlook, like food and fuel, have been realised, and other risks, such as currency volatility and capital flow reversals, have become more pronounced,” the statement said.

- The Colombian Central Bank’s Board of Directors raised the policy rate by 50 basis points to 3% in a 4–3 majority decision. Three members voted for a 75-bps increase. “All the Board Members agreed that the increases in inflation and inflation expectations and the high rate of economic activity, which has been reducing spare capacity, warranted the continued withdrawal of monetary stimulus,” they said.

- The Hungarian Central Bank’s Monetary Council raised the central bank base rate by 50 basis points to 2.90%. “Inflation risks warrant a further tightening of monetary conditions,” it said, “accordingly, the Council will continue the cycle of base rate hikes at a monthly frequency and in larger increments than in December.”

- The Monetary Authority of Singapore tightened its foreign exchange policy, arguing that it was necessary to ensure price stability, even as the strength of the economic recovery remained uncertain. “There remain upside risks to inflation arising from the impact of pandemic-related and geopolitical shocks on global supply chains,” it said.

- The Bank of Canada’s Governing Council announced that the ongoing economic recovery has reached a point where it can now end its commitment to keep its policy rate at very low levels. “Looking ahead, the Governing Council expects interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving the 2% inflation target,” it said.

All Posts

All Posts