This Week In The Economy: Over 4 Million Dead From Coronavirus, and More

By Brai Odion-Esene

July 08, 2021

Welcome to a regular snapshot-review of U.S. and international economic news that aims to 1) provide a window into the challenges and decisions facing businesses today, 2) determine the direction of economic policy — such as the speed at which central banks decide to raise interest rates, and 3) assess what the impact will be for consumers.

COVID-19 Claims Over 4 Million Lives Worldwide

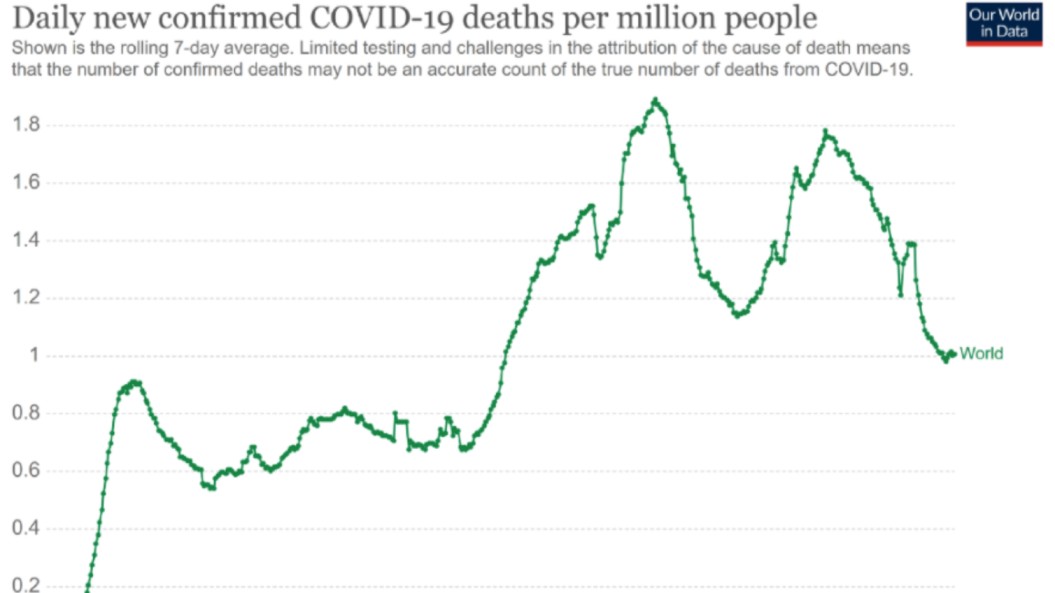

A lot of attention has been devoted to the development of the coronavirus vaccines, governments’ efforts to inoculate their citizens, and economies re-opening, but events this week made clear the pandemic continues to exact a very tragic toll.

Globally, there have now been 185,650,024 confirmed cases of COVID-19, with 4,012,453 fatalities. The U.S. now has 33,879,911 confirmed cases, and there have been 611,249 fatalities.

The highly-infectious Delta variant is spreading rapidly, with the U.S. Centre for Disease Control Director Rochelle Walensky warning this week that “we are starting to see some new and concerning trends. Simply put, in areas of low vaccination coverage, cases and hospitalizations are up.”

Speaking during the White House’s weekly public health briefing, Walensky said the Delta variant is “spreading rapidly” throughout the U.S., and is now believed to be the most prevalent variant in the United States, representing over 50% of cases — and as high as 80% in some parts of the country — up from 26% from the week ending June 19.

“Although we expected the Delta variant to become the dominant strain in the United States, this rapid rise is troubling,” Walensky said.

This comes as the Japan’s government this week declared a state of emergency for Okinawa and Tokyo until August 22nd, and announced that no spectators will be allowed at the Olympic Games set to begin this month.

On the vaccine front, Pfizer and BioNTech announced this week that they are developing a version of the coronavirus vaccine that targets the Delta variant. The companies expect to begin clinical trials of the vaccine in August.

The results of a study published in the Nature journal showed that just one shot of the Pfizer or AstraZeneca vaccines barely any effect against the Delta variant. However, for individuals who had received two doses, the odds of neutralizing the virus jumped to 95%.

President Biden issued a plea this week for more Americans to get vaccinated, noting that “millions of Americans are still unvaccinated and unprotected. And because of that, their communities are at risk.”

Describing the Delta variant as “more easily transmissible, potentially more dangerous,” Biden said it should cause everyone who is not yet vaccinated to reconsider their decision.

He announced a pivot in the administration’s strategy from an emphasis on mass vaccinations sites to a more hyper-localized effort, one focused on going “community by community, neighborhood by neighborhood, and oftentimes, door to door — literally knocking on doors — to get help to the remaining people protected from the virus.”

Walensky announced that the United States’ seven-day average for new COVID-19 infections is 13,900 cases per day — a nearly 11% from the prior seven-day average. The seven-day average of hospital admissions is about 2,000 per day, an increase of about 7% from the prior seven-day average.

The seven-day average of daily deaths is about 184.

“Of the 173 counties with the highest case rates, the vast majority — 93 percent — have less than 40 percent vaccination of their residents. These counties are where more than 9 million Americans live and work, and are the locations in the country where we are seeing the increased hospitalizations and deaths among unvaccinated individuals,” she said.

She said the Delta variant in the coming weeks will become the most prevalent variant in the United States, noting that an estimated 25% of all reported coronavirus cases nationwide are the Delta variant. And in some regions of the country, nearly one in two cases is the Delta variant.

“There are communities that are vulnerable and where we are now seeing surges in cases, and indeed also hospitalizations, due to what could be the spread of the Delta variant and low vaccination rates in these communities,” Walensky said.

She warned that “the low vaccination rates in these counties coupled with high case rates and lax mitigation policies that do not protect those who are unvaccinated from disease will certainly and sadly lead to more unnecessary suffering, hospitalizations, and potentially death.”

The Center for Disease Control reported that as of July 8, 385,495,790 total doses of the COVID-19 vaccine have been distributed to states, compared to 382,283,990 on the same day last week. Of this week’s overall number, 332,345,797 shots have been administered. Of the doses administered, 183,237,046 Americans have received at least one shot (55.2% of the entire population), and 158,287,566 have been fully vaccinated (47.7%).

Worldwide, there have now been 3,353,952,511 vaccine doses administered, but massive gaps still remain:

India now has 30,752,108 confirmed cases. Of that number, 465,417 are active and there have been 405,967 fatalities. The data shows just over 22% of India’s population has received at least one jab of the COVID-19 vaccine, and a little over 5% are fully vaccinated.

Brazil is in third place with 18,962,762 cases at time of writing — 1,009,729 active and 530,179 deaths. France remains in fourth place with 5,799,107 cases — 5,346,673 of that number are active, and there have been 111,313 fatalities.

Russia remains in fifth place with 5,733,218 confirmed cases — 426,630 active and 141,501 deaths.

Turkey is in sixth place with 5,465,094 cases — of that number 81,239 are active and 50,096 dead. The United Kingdom remains in seventh with 5,022,893 cases, and has had 128,336 fatalities. The UK government this week announced its plan to fully re-open the economy on July 19th and end all limits on gatherings.

The pandemic continues to run rampant in South America. Argentina is in eighth place with 4,613,019 cases — 288,421 active and 97,904 deaths. Colombia is now ninth with 4,450,086 confirmed cases, 166,913 active and 111,155 fatalities.

Italy is in tenth place with 4,267,105 cases — 41,469 active and 127,731 deaths.

IMF Warns Of Worsening Two-Track Recovery

There is a growing divergence in economic fortunes underway in the global economy due to the COVID-19 pandemic, with a large number of countries falling further behind, the head of the International Monetary Fund warned this week.

“The world is facing a worsening two-track recovery, driven by dramatic differences in vaccine availability, infection rates, and the ability to provide policy support,” IMF Managing Director Kristalina Georgieva wrote in a blog post, describing it as a “critical moment” that requires “urgent policy action” by the world’s major economies.

The IMF estimates that that faster access to vaccinations for high-risk populations could potentially save more than half a million lives in the next six months alone.

Georgieva warned that unvaccinated populations anywhere in the world raise the risk of even deadlier COVID-19 variants emerging, undermining progress everywhere and inflicting further harm on the global economy.

In addition, dwindling fiscal resources will make it even harder for poorer nations to boost vaccinations and support their economies. “This will leave millions of people unprotected and exposed to rising poverty, homelessness, and hunger. The crisis has already caused rising food insecurity, and concerns are now growing in many countries over further spikes in food price inflation,” she said.

Georgieva called on G20 nations to step up support to vulnerable countries, and that it is critical that healthcare and vulnerable households and firms continue to receive support. “Securing the recovery also requires continued monetary accommodation in most countries,” she added. “This has to be coupled with closely monitoring inflation and financial stability risks. In countries where the recovery is accelerating, including the US, it will be essential to avoid overreacting to transitory increases in inflation.”

Federal Reserve Divided Over Timing Of Monetary Stimulus Withdrawal

The Federal Reserve this published the minutes from the June meeting of the Federal Open Market Committee. All eyes were on any signal from gathering about when the central bank might begin dialing back its aggressive support for the U.S. economy — especially its multi-billion dollar purchases of government and mortgage-backed securities.

The report noted that various participants expected the conditions for beginning to reduce the pace of asset buys to be met somewhat earlier than they had previously anticipated based incoming data. On the other hand, some viewed the incoming data as providing a less clear signal about the economy’s progress and judged that the FOMC would have more information in coming months to make a better assessment of the labor market and inflation.

“As a result, several of these participants emphasized that the Committee should be patient in assessing progress toward its goals and in announcing changes to its plans for asset purchases,” the minutes said.

Given the ongoing inflation debate, here are some relevant snippets that capture the central bank’s views on the issue.

For the most part, Fed officials maintained their expectation that recent price increases will be transitory, and there was no mention of wage inflation as a major cause for concern.

From the Discussion Among FOMC Participants:

- “Participants generally agreed that the economic recovery was incomplete and that risks to the economic outlook remained. Although inflation had risen more than anticipated, the increase was seen as largely reflecting temporary factors, and participants expected inflation to decline toward the Committee’s 2 percent longer-run objective.”

- “Citing recent wage data and reports from business contacts, many participants judged that labor shortages were putting upward pressure on wages or leading employers to provide additional financial incentives to attract and retain workers, particularly in lower-wage occupations.”

- “Participants attributed the upside surprise to more widespread supply constraints in product and labor markets than they had anticipated and to a larger-than-expected surge in consumer demand as the economy reopened.”

- “Looking ahead, participants generally expected inflation to ease as the effect of these transitory factors dissipated, but several participants remarked that they anticipated that supply chain limitations and input shortages would put upward pressure on prices into next year.”

From the Fed Staff’s review of the economic situation:

- “The pace of increases in several measures of labor compensation had moved up in recent months. Average hourly earnings for all employees jumped at a sizable monthly rate in April and May, even though the large job gains in the leisure and hospitality sector — where wages tend to be lower than in other sectors — likely held down the increases in average hourly earnings in these months. A staff measure of the 12‑month change in the median wage derived from the ADP data had stepped up significantly in April relative to March. The employment cost index of total hourly compensation in the private sector increased at an annual rate of 4 percent in the three months ending in March, a notably faster pace than over the previous three months.”

- “Over the next year, the transitory price increases caused by bottlenecks and supply constraints were expected to largely reverse, and the growth in demand was forecast to ease. As a result, inflation was projected to slow to slightly below 2 percent in 2022 before moving back up to a bit above 2 percent in 2023, supported by high levels of resource utilization.”

EU Commission’s Forecasts Buoyed By Summer Re-Openings

The European Commission this week published updated forecasts for economic activity, employment, and inflation within the bloc, predicting faster growth as COVID-19 lockdown measures are relaxed.

According to its Summer 2021 interim Economic Forecast, the economy in the EU and the euro area is set to expand by 4.8% this year and 4.5% in 2022. Real GDP is projected to return to its pre‑crisis level in the last quarter of 2021 in both the EU and the euro area.

Consumer spending and business investment are expected to be the main drivers of growth, supported by an increase in employment that is expected to move in tandem with economic activity.

EU inflation is now forecast to average 2.2% this year and 1.6% in 2022, respectively. In the euro area, inflation is forecast to average 1.9% in 2021 and 1.4% in 2022. “Uncertainty and risks surrounding the growth outlook are high but remain overall balanced,” the report said. “The threat posed by the spread and emergence of variants of concern underscores the importance of a further rapid increase in full vaccination.”

It added that, “economic risks relate in particular to the response of households and firms to changes in restrictions and the impact of emergency policy support withdrawal.”

The EC also warned that inflation may turn out higher than forecast “if supply constraints are more persistent and price pressures are passed on to consumer prices more strongly.”

The European Central Bank’s Governing Council this week adjusted its price stability mandate by announcing it will now target a 2% inflation rate “over the medium term.”

It stressed that “the Governing Council’s commitment to this target is symmetric. Symmetry means that the Governing Council considers negative and positive deviations from this target as equally undesirable.”

All Posts

All Posts